A battery does not earn from a single source. It creates value in several

ways. Some benefits come from household savings. Others come from

grid services. Some come from avoiding the most expensive hours of

electricity use. Combined, these streams create a stable financial effect

that is often underestimated.

This is how a BESS generates real value.

Why arbitrage is the first and easiest revenue

Electricity prices change throughout the day. Some hours are cheap. Others are expensive.

A BESS uses this difference:

• it stores energy when prices are low

• it uses stored energy when prices are high

This is basic arbitrage: buy low, use high. For a household, this means fewer expensive evening

imports and greater use of cheap night-time or solar energy.

No trading screens, No financial expertise, Just timing.

Why reserve markets pay for fast response

Electricity grids require stability. Frequency must remain within narrow limits. When demand rises

or supply drops, the system needs an immediate response. This is where a BESS becomes

valuable.

The main reserve services are:

• FCR, responding within seconds

• aFRR, responding within minutes

• mFRR, supporting the grid during larger imbalances

In simple terms, the grid pays batteries to stay available and react quickly.

For the battery owner, this is passive income. The software manages everything automatically. The

battery earns because it can move power with speed and precision.

Why peak shaving saves money even without markets

• Peak hours are the most expensive hours of the day. Every household has them.

• Without storage, electricity must be purchased exactly when prices are highest. A BESS absorbs

that peak.

• Instead of drawing power from the grid at the most expensive moment, the household uses

stored energy. This reduces peak consumption.

• For households, this lowers evening electricity bills. For commercial users, it can significantly

reduce demand charges.

• Peak shaving is simply avoiding the worst hours.Why solar plus storage creates its own revenue stream

Without storage, surplus solar energy is often exported at low wholesale prices. With storage, that

energy is kept and used later when electricity is more expensive.

This delivers two benefits:

• higher self-consumption

• fewer purchases during peak-price hours

The value is not in selling electricity.

The value is in not buying it at high cost.

This is the revenue many households overlook until they see the numbers.

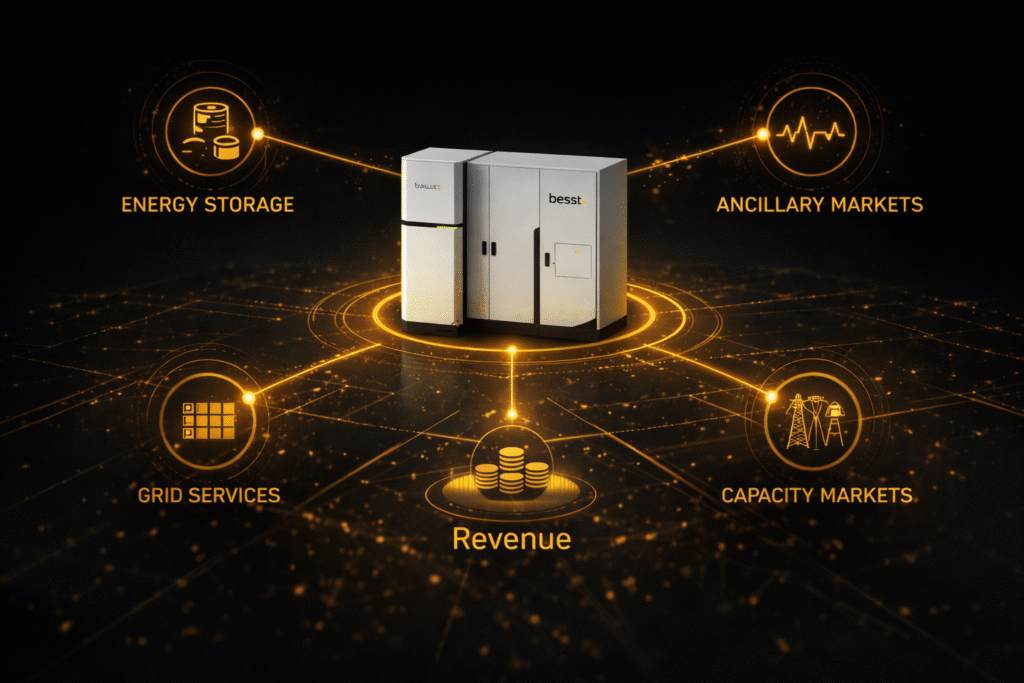

Why stacking all streams makes BESS financially powerful

Each value stream alone is modest. Together, they form a reliable system:

• arbitrage lowers daily energy costs

• reserve markets add passive income

• peak shaving limits exposure to extreme tariffs

• solar self-consumption improves long-term returns

• volatility protection adds stability

This is why modern storage systems focus on revenue stacking. One battery. Multiple value

streams. A predictable long-term effect.

Why households should understand this breakdown

A BESS is not magic. It is a financial tool that extracts value from timing, grid needs, and price

patterns.

Households install batteries for different reasons, but the money always comes from the same

three places:

• price differences between hours

• grid payments for stability

• avoiding the most expensive moments

This is how your battery earns.