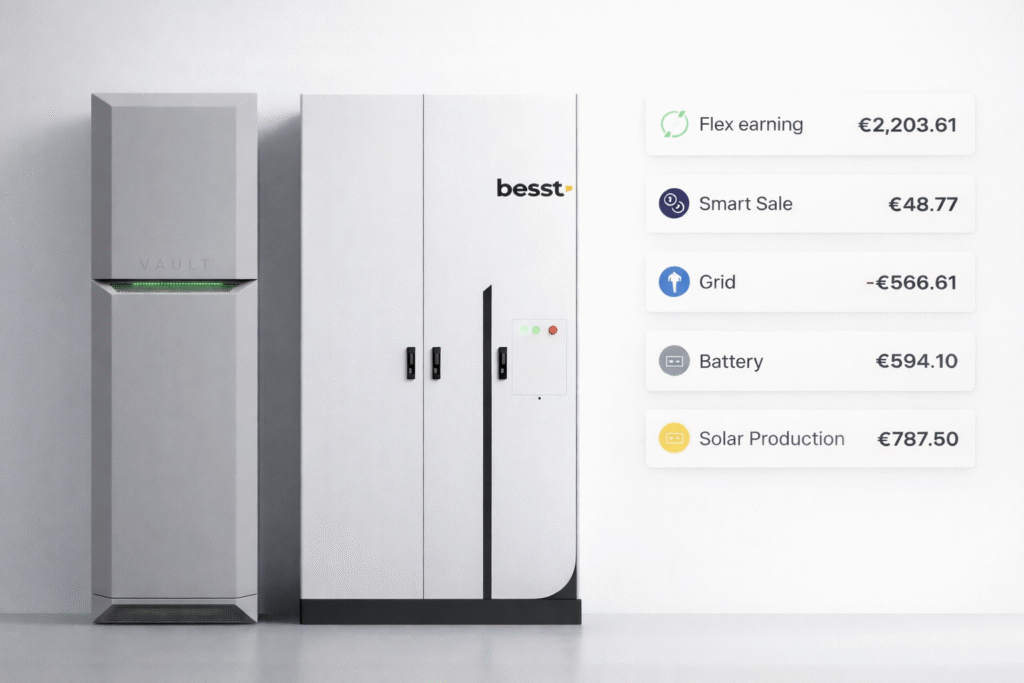

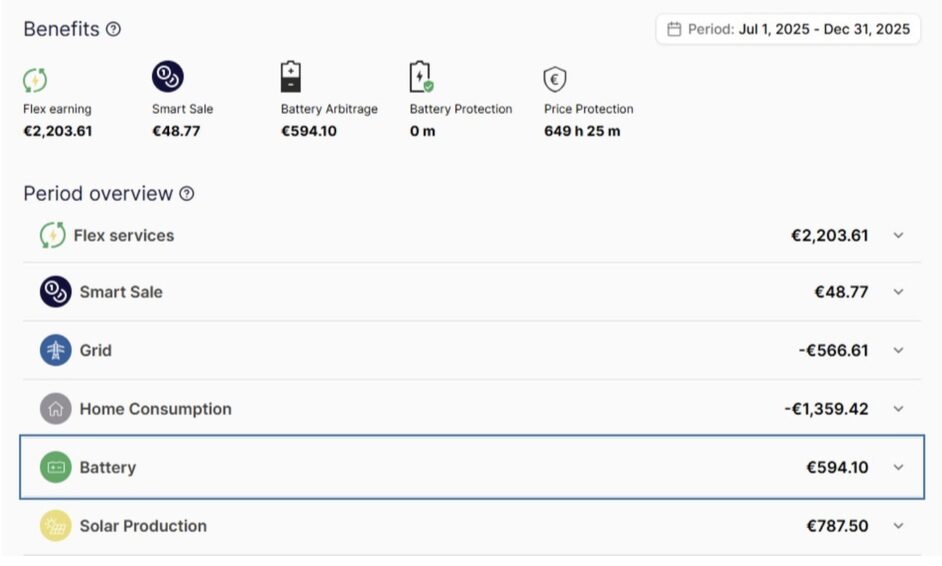

These results come from a real operating household battery system over a fixed period: July 1, 2025 – December 31, 2025. Six months of realized value.

Where the profit comes from (what each line means)

1) Flex services: €2,203.61 (main revenue)

The battery gets paid for supporting the grid:

• provides availability and fast response power

• charges/discharges when the system needs balancing

• supports frequency stability

It is payment for delivered grid service, fully automated by software.

2) Battery arbitrage: €594.10 (price spread profit)

The battery earns from the electricity price difference:

• charges when prices are low

• discharges when prices are high

• avoids peak grid imports

This value repeats daily and accumulates over months.

3) Smart Sale optimization: €48.77 (export control)

Small, but important:

• exports only when prices justify it

• avoids exporting during weak pricing windows

This prevents constant value leakage.

4) Solar value retained: €787,50 (avoided cost)

Solar energy that was:

• stored and used later

• not sold cheap midday

• not repurchased expensive in the eveningNot “cash income”, but money saved, financially equivalent.

The result is stable because value comes from stacking:

• grid service revenue

• price spread capture

• export optimisation

• solar shifting

Scaling to 30 kWh AIO

Using 30 kWh household system as an average benchmark, the same stacking scales with capacity. A 30 kWh AIO system delivers about +50% higher total value over the same Jul–Dec window. Expected 6-month stacked value for 30 kWh AIO: ~€5,450.98