Most households assume solar always saves money. In reality, solar without storage creates several hidden losses that grow larger each year. Net-billing reduces export value. Midday prices collapse during solar peaks. Grid curtailment limits usable generation. A battery offsets these losses by keeping energy inside the home, stabilising consumption, and protecting long-term returns.

Why net-billing reduces solar value

Under older net-metering schemes, exported electricity was credited at the same rate as consumption. Across Europe, this model is being replaced by net-billing.

Under net-billing:

• exported solar is paid at low wholesale-based prices

• imported electricity is charged at full retail tariffs

This creates a structural loss. Energy is sold cheaply and bought back at a premium every day. A battery reduces exported volume and increases self-consumption, directly narrowing the gap created by net-billing.

Why low export prices erode your return

Solar output peaks when sunlight is strongest and when thousands of other homes generate simultaneously. This creates midday oversupply, pushing export prices down.

Without storage:

• the highest production hours earn the least

• energy cannot be shifted to high-value periods

• returns decline even if generation is strong

With storage, surplus solar is kept and used during evening peak hours when electricity is more valuable. This corrects one of the largest hidden losses of solar-only systems.

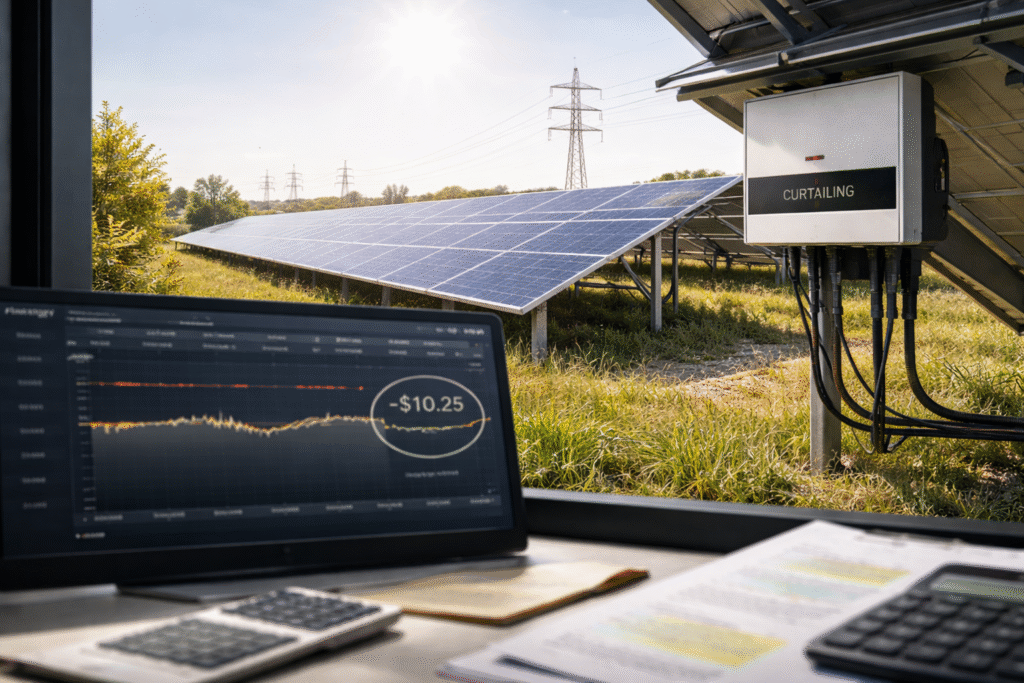

Why curtailment is becoming a real issue

In regions with high rooftop solar penetration, grids increasingly limit exports during peak generation periods. Curtailment does not reduce equipment cost. It simply reduces usable output.

Losses occur through:

• export caps

• inverter power reductions

• forced disconnection during high-voltage events

A battery absorbs surplus locally, reducing exported load and lowering the risk of curtailment. This

preserves generation that would otherwise be lost.Why solar-only homes face rising long-term risk

Solar systems without storage are exposed to:

• declining export compensation

• rising evening tariffs

• increasing grid saturation

• higher curtailment risk

• policy changes affecting feed-in value

• growing grid fees during peak demand

These factors explain why many early solar installations fail to meet expected payback timelines.

How BESS offsets each financial loss

A battery addresses the exact points where value leaks:

• net-billing losses through higher self-consumption

• low midday prices by shifting energy to peak hours

• curtailment by absorbing excess locally

• volatility by reducing evening imports

• long-term risk by stabilising energy costs

Storage does not increase generation. It increases how much of that generation you actually keep.

Conclusion

Every solar-only household loses value through low export prices, time-based price gaps, and increasing curtailment pressure. These losses accumulate quietly and weaken system economics over time. A BESS closes these gaps by shifting solar energy to the hours when it holds the highest value, reducing exposure to market rules and protecting long-term returns. Solar generates electricity. Storage preserves its value.