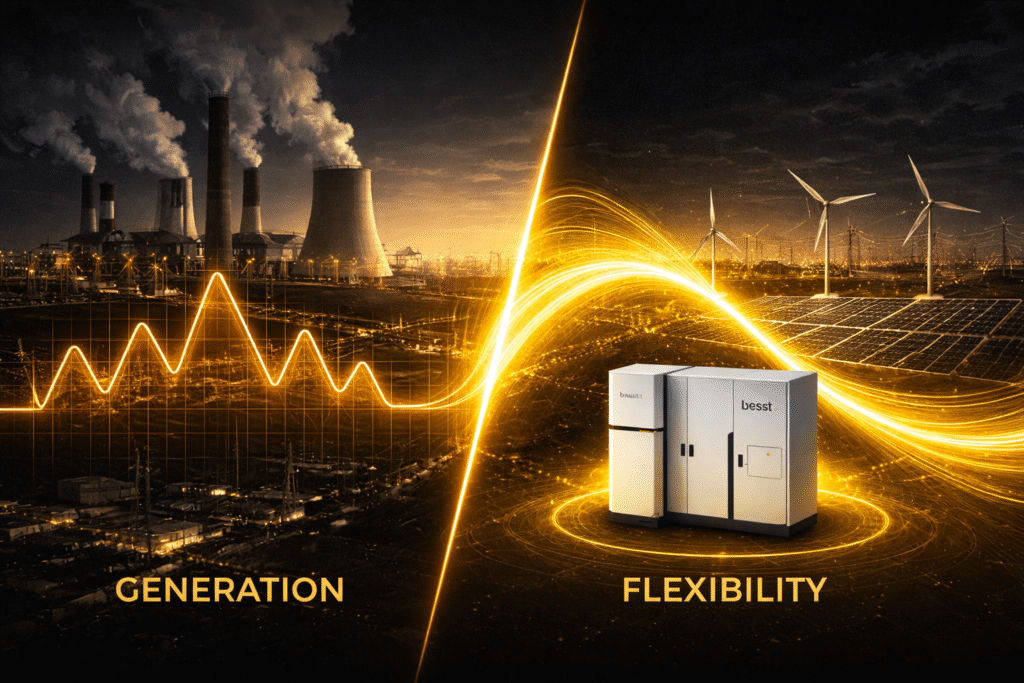

Renewables swing between surplus and scarcity. The grid pays for the assets that can move power across that gap. That is flexibility. A battery delivers it with the highest precision.

Why generation loses value

When renewables surge, prices fall fast. In several European markets the price already goes near zero or below zero during strong solar hours. In those periods, new generation adds no value. It

increases oversupply and deepens volatility. The market now values timing, not pure megawatts. If you cannot respond quickly, there are nobenefits.

Why batteries earn in low-price hours

Low-price periods are caused by excess renewable output. The system needs assets that canabsorb this surplus. A battery charges exactly in these hours.

• It buys the cheapest power.

• It reduces renewable curtailment.

• It stabilises the grid when production spikes.

Some balancing programs even pay flexibility assets for absorbing excess energy. This is the firstrevenue channel.

Why batteries earn in high-price hours

When renewable output drops, the system tightens. Prices rise. Response speed becomes themain advantage. Traditional plants need time. A battery reacts instantly.

This creates the second revenue channel.

• It discharges into the highest-price hours.

• It sells stored energy at a premium.

• It provides frequency response and balancing services.

The same asset earns on both sides of the curve.

Why flexibility beats generation

• Generation earns only when it produces.

• A battery earns when it charges.

• It earns when it discharges.

• It earns in ancillary markets that generators cannot access.

• Two-sided revenue.

• High system value.

• Precision over volume.

European regulators now place flexibility at the centre of system planning. It is the only reliable way

to stabilise a grid dominated by variable renewables.